The GRM framework for UPI is based on Four Pillars. The Four Pillars consist of four Consumer Values that users seek from a GRM and corresponding Product Principles applicable to design effective GRM, which banks and third-party applications can implement.

Below are summaries of the Four Pillars and how they are translated as solutions within the GRM:

1. Inclusive

Inclusiveness is foundational to the GRM. An inclusive approach ensures every user, irrespective of socioeconomic or geocultural backgrounds, and varying levels of digital proficiency, can access the GRM and can seek a successful resolution for issues faced.

Product principle: Accessibility

Accessibility within a GRM is for its users to be able to discover and access the GRM without complicated navigation. It also entails access across all stages within the GRM; so users can carry out necessary actions to seek redress and resolution.

Applied in our solutions

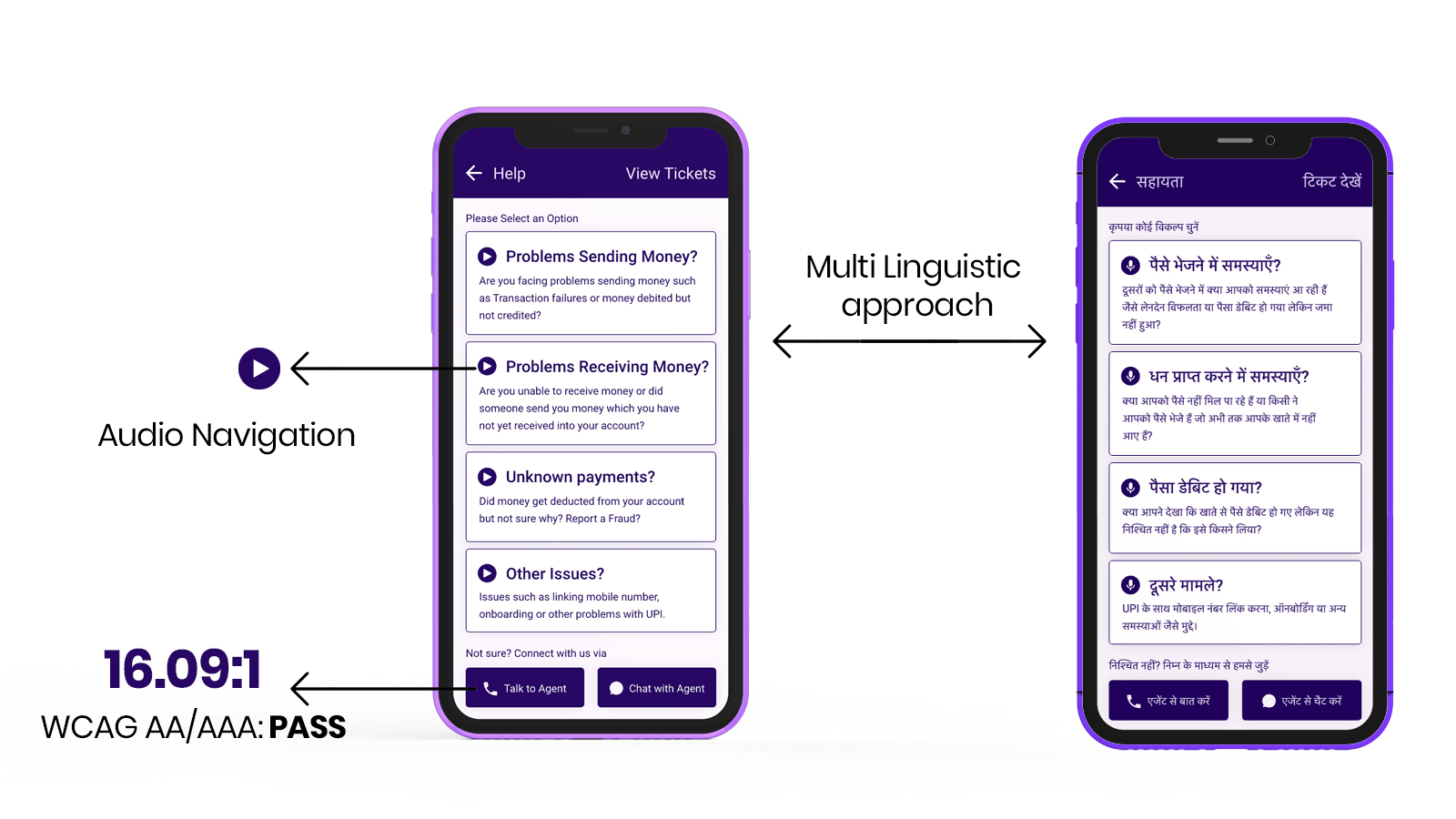

- Multi-Lingual approach: Our Toolkit supports the application’s ability to offer users the option to choose from multiple languages in order to access content in their preferred language, just as users today can match the language of the application with that of their mobile operating systems. The UPI App will need the support of multilingual service agents as well as Indic-language enabled chatbots to complete this functionality.

- Audio Playback: We have integrated audio functionality, thus offering an alternative method to the user for consuming information. Through audio playback provisions, the Toolkit accommodates users with diverse literacy levels, learning preferences, and abilities.

- AA Rating: We prioritise maintaining a Web Content Accessibility Guidelines (WCAG) AA rating, ensuring sufficient contrast for readability across all text and interface elements. This commitment enhances usability for individuals with visual impairments or readability challenges.

2. Simplified process

A simplified process improves the transparency of the GRM system and its processes to its users, through ease of comprehension and visibility to front-end users (consumers) and back-end users (UPI service providers). This value creates clarity for both sides and builds long-term trust amongst users to proactively seek redressal through the GRM.

Product principle: Transparency

This principle ensures users get to understand their grievances and the associated risks; and this can in turn, build trust with the app. Transparency of simplified processes leads to clarity and visibility for both businesses and customers. It can eliminate user anxiety associated with limited information and lack of knowledge in the GRM process.

Applied in our solutions

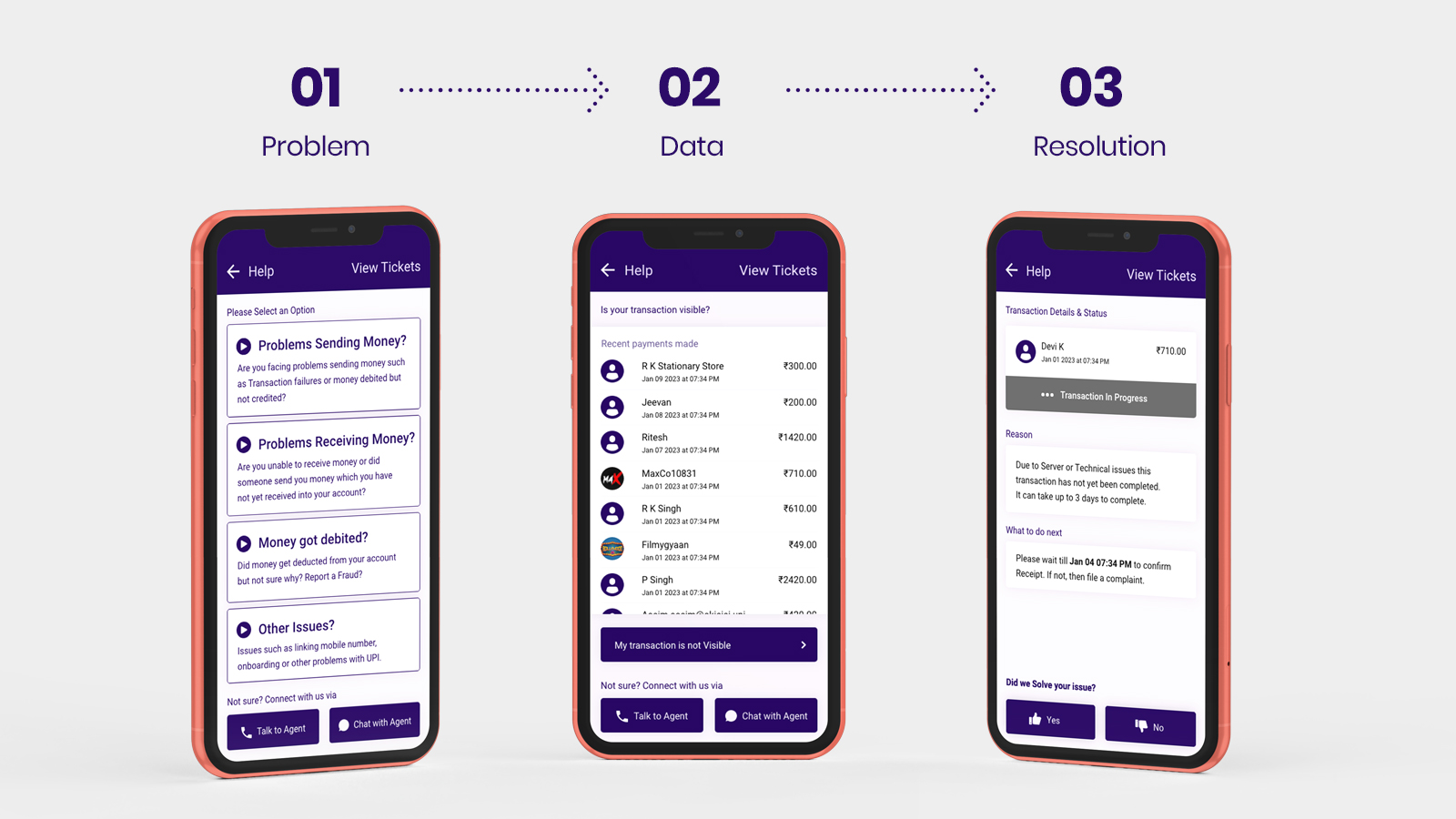

Decision-making becomes significantly easier when users are presented with a reduced number of options. On this basis, we began to carefully examine the support journey, striking an optimal balance between the number of steps and the number of options available at each step. By doing so, we aimed to craft an optimal user journey from issue identification to solution attainment.

The approach is applied in the Toolkit by:

- Structuring an effective Help Navigation Tree that synchronises the efforts of the front-end user in obtaining resolution with that of the back-end customer support team. It allows users to navigate and select an articulation of the issue, such that it would reflect exactly, what would be referred by the customer support team while providing support (by following defined protocols and processes for finding the most relevant resolution). This helps build transparency and avoids confusion experienced in arriving at the correct interpretation of the issue at hand. Refer to the Help Navigation Tree in the Toolkit for more details about our process.

- Deploying a Self-Resolution approach allows us to design a more guided resolution for users at each step by providing additional information, clarity on expected TAT and temporary assurances. These elements lower users’ anxiety around obtaining resolutions.

- Providing clarity on Turn Around Time (TAT) during the resolution journey by making it more visible to end-users. Transparency through TATs builds more trust with the UPI service providor.

- Creating a dedicated space like a ticket dashboard, where users can view all tickets and check for ticket status updates.

3. Resolution

Providing resolutions for user grievances is the main goal of the GRM. Consistent user engagement for resolutions that are clear and comprehensible must be an integral component of the support journey. Over time, successful resolutions will build more trust amongst consumers and a higher engagement with the GRM. It can also help service providers leverage the GRM for feedback and identify improvement areas in UPI.

Product principle: Objectivity

Objectivity within an application ensures users are provided with resolutions that are clear and fair. Objective resolutions require a clear classification of issues and impartial solutions for grievances in the back-end. When objectivity is applied at the back-end, issues are generally resolved without biases. Consumers might then interpret the resolutions with the same objectivity lens as the back-end.

Applied in our solutions

- The Help Navigation Tree is also applicable in this principle as the structure of this tree has been carefully designed to establish objectivity around how we categorise and define problems. At each level of the problem category, we have removed any subjectivity towards a potential problem and this allows us to build a more objective and guided resolution journey.

- The Self-Resolution journey is a three-step process of problem-identification, data-gathering, and then resolution. At each stage we have minimal options for the user to choose from, building objectivity, focus, and potentially making the overall progress faster. These steps allow users to gain more clarity on issues and gain resolution in the end, without raising a ticket or waiting for customer support to contact them with a solution.

Once we get to the resolution we provide:

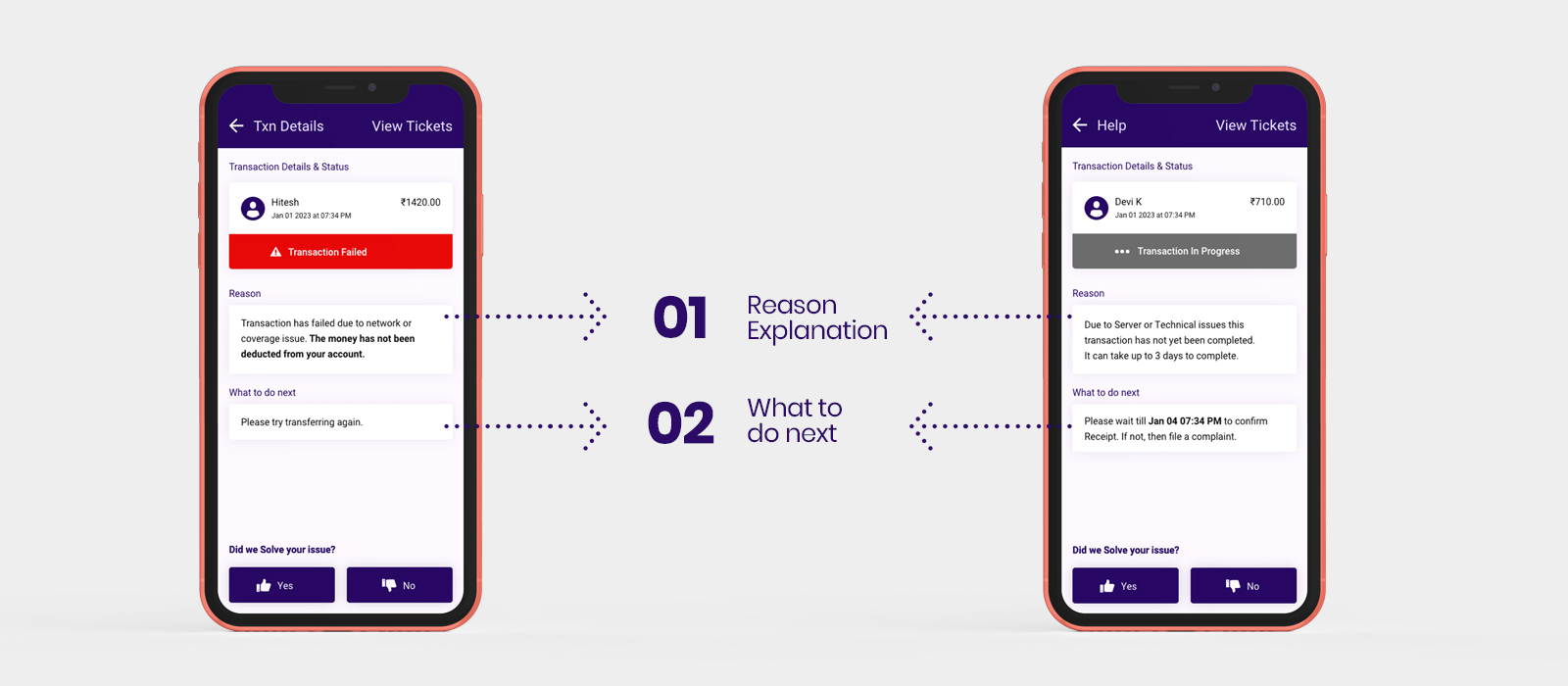

- Reason Explanation: Utilising the data associated with the user’s issue, such as transaction details, and applying objective logic regarding issues, we articulate, in simple language, potential reasons for the issue. By avoiding jargon, we minimise ambiguity and establish trust with the user. This transparency ensures users understand the underlying cause of their concern.

- What to do next: Providing a dedicated space for the “What to do next” section ensures clarity for users regarding the necessary actions they could take, to resolve their issues. We outline clear, actionable steps that users can take to address the issue effectively. This structured approach of actions allows users to navigate the resolution process with confidence, facilitating a smoother and more efficient experience.

4. Protection

Users engage with the GRM to seek protection from potential loss, fraud or any perceived threat. When users experience protection from an application, they can build trust in UPI. Effective protection leads to better adoption and engagement with the GRM and builds trust in using UPI across a wider range of payment use cases.

Product principle: Guardrails

An application with ‘guardrails’ entails that the product and its features are designed with a preventive and protective approach in mind. The scope for this principle covers ex-ante and ex-post aspects for the GRM. The application’s GRM interface needs to warn and remind users about potential risks or suggest certain steps they can take to avoid potential loss. It also needs to be protective by providing temporary assurance to users about their grievances and aiding users to comprehend potential loss, digital error, or perceived fraud. We have predominantly covered ex-post (after the issue occurance) solutions in the GRM as part of our scope.

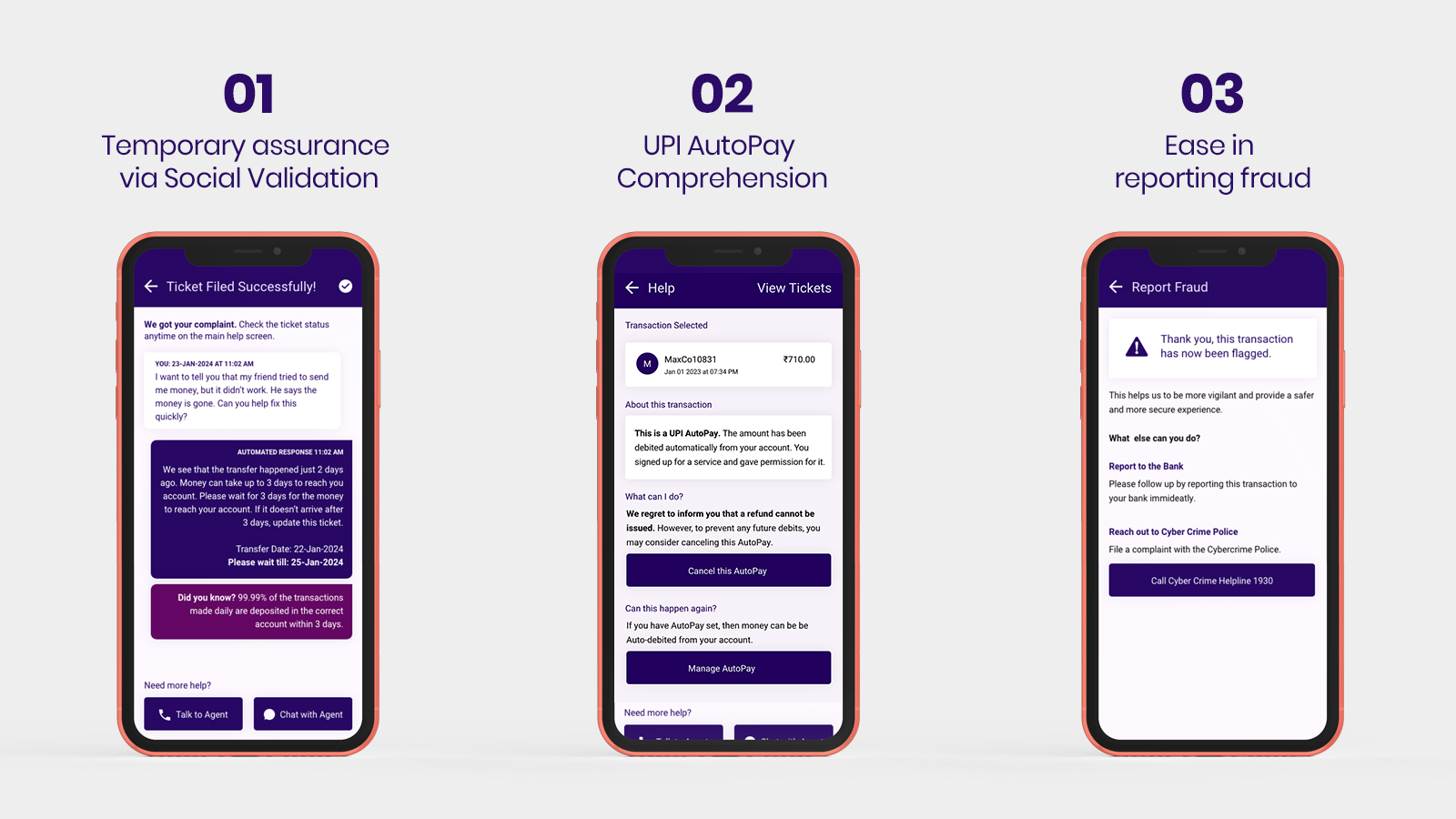

Applied in our solutions

- Temporary assurance via Social Validation:To alleviate user anxiety and provide reassurance, we incorporate analytical data that serves the purpose of social validation. By presenting positive reinforcement through relevant statistics or feedback, we offer users evidence of successful resolutions or positive outcomes associated with similar issues. This not only instils confidence in the resolution process but also reduces apprehension and uncertainty, thereby enhancing the overall user experience.

- UPI AutoPay Comprehension: Users are unable to comprehend why money is debited automatically as they do not comprehend the many use cases with the AutoPay feature. The resolution steps have been broken down for UPI AutoPay in the case of merchant to bank, aiding users to comprehend the resolution content and the options for them to opt-out or follow up with the bank. While many new features keep getting introduced in UPI, the UPI AutoPay is a specific feature we chose to showcase as a use-case where the GRM can help improve comprehension for the user in not just an ex-post but also an ex-ante way.

- Ease in reporting fraud: The solution focuses on aiding users to comprehend and report fraud more easily in a self-resolution flow of steps, when unknown debit or credit transactions happen. It helps users to comprehend potentially fraudulent transactions while engaging with the steps towards reporting, thereby helping to avoid future or further loss.